Quick Summary

This article outlines the benefits of electronic signatures for accountants, emphasizing enhanced efficiency, improved security, and cost savings. E-signatures streamline document processing, reduce turnaround times, and lower fraud risks. They also support compliance through detailed audit trails and improve client experiences by allowing convenient signing from any device.

Additionally, e-signatures promote environmental sustainability by reducing paper usage and carbon emissions, ultimately providing accountants with a competitive advantage. Explore our resources for more insights on the benefits of electronic signatures.

Want to Know the Benefits of Electronic Signatures for Accountants?

Did you know that organizations can improve efficiency by 70 to 80% by utilizing electronic signatures? This game-changing tech not only streamlines workflows but also enhances security and compliance. As accountants seek to optimize their operations, understanding the myriad benefits of e-signatures becomes essential for staying competitive and providing superior client service.

If you’re in the accounting world, you’ll know that every minute counts, and this is where e-signing comes into play. Keep reading as SignWell takes you through eight benefits of electronic signatures for accountants for a more efficient firm and happier clients.

Why Listen to Us?

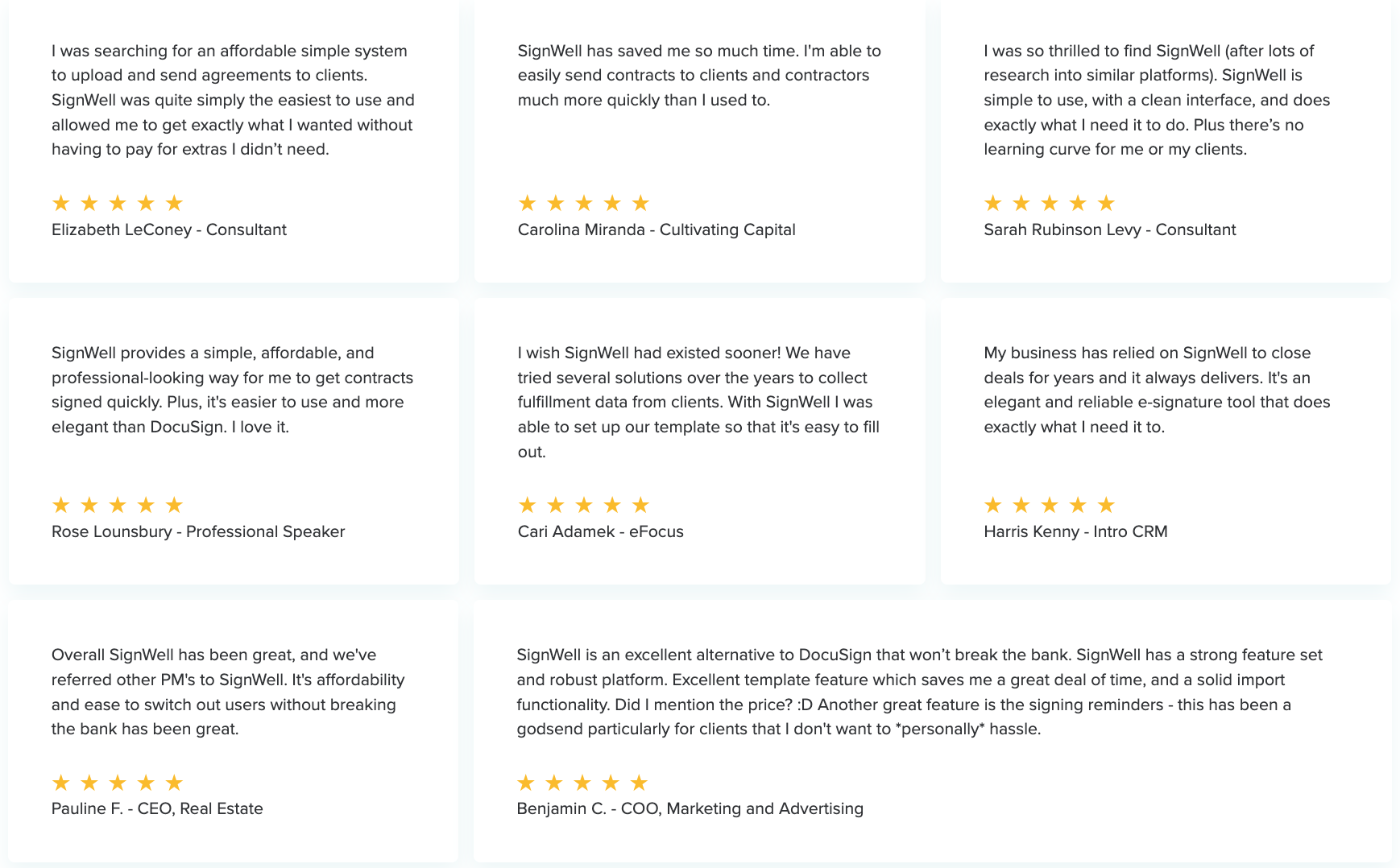

At SignWell, we’re trusted by thousands of companies for our secure, efficient, and easy-to-use e-signature solution. With years of industry expertise, we understand the unique needs of accountants, offering customizable workflows, strong security, and full compliance with regulations like ESIGN and eIDAS.

Our platform ensures your documents are signed quickly, securely, and legally binding, giving you peace of mind and helping you deliver superior service to your clients.

8 Benefits of Electronic Signatures for Accountants

1. Enhanced Efficiency

Electronic signatures reduce document turnaround times from days to hours. Accountants can send tax documents, client agreements, invoices, payment authorizations, and more for signature and receive them back in a snap, allowing them to meet tight deadlines more easily.

Furthermore, electronic signatures significantly streamline document processing, eliminating manual tasks like printing, mailing, and filing. This automation frees up valuable time accountants would otherwise spend on repetitive admin work.

As a result, accountants can redirect their efforts towards higher-value activities such as providing strategic financial advice and in-depth analysis for clients.

2. Improved Security and Fraud Prevention

Accounting firms using electronic signatures will likely see significant reductions in document fraud and identity theft. E-signatures provide the following enhanced features, making it harder for unauthorized parties to tamper with or forge documents:

- Enhanced authentication: E-signing platforms often use multi-factor authentication methods such as email verification, SMS codes, or biometric data.

- Tamper-evident documents: Digital documents signed electronically are typically encrypted and include tamper-evident seals. Any alterations made after signing are easily detectable, ensuring the integrity of financial documents.

- Encryption and data protection: Electronic signature platforms typically use advanced encryption techniques to protect sensitive financial information during data transmission and storage.

3. Cost Savings

According to Forbes, organizations can improve efficiency by 70% to 80% using an accountant e-signing solution.

This increase in efficiency translates directly to cost savings for accounting firms, as it allows them to handle more work in less time, reducing labor costs and increasing productivity.

While this statistic doesn’t provide a direct dollar amount, the productivity gain shows how cost-effective electronic signatures can be for accountants. E-signatures dramatically improve workflows, enabling accounting firms to save on labor costs, paper and printing expenses, and time spent on administrative tasks, all of which contribute to overall cost reduction.

4. Improved Compliance and Auditability

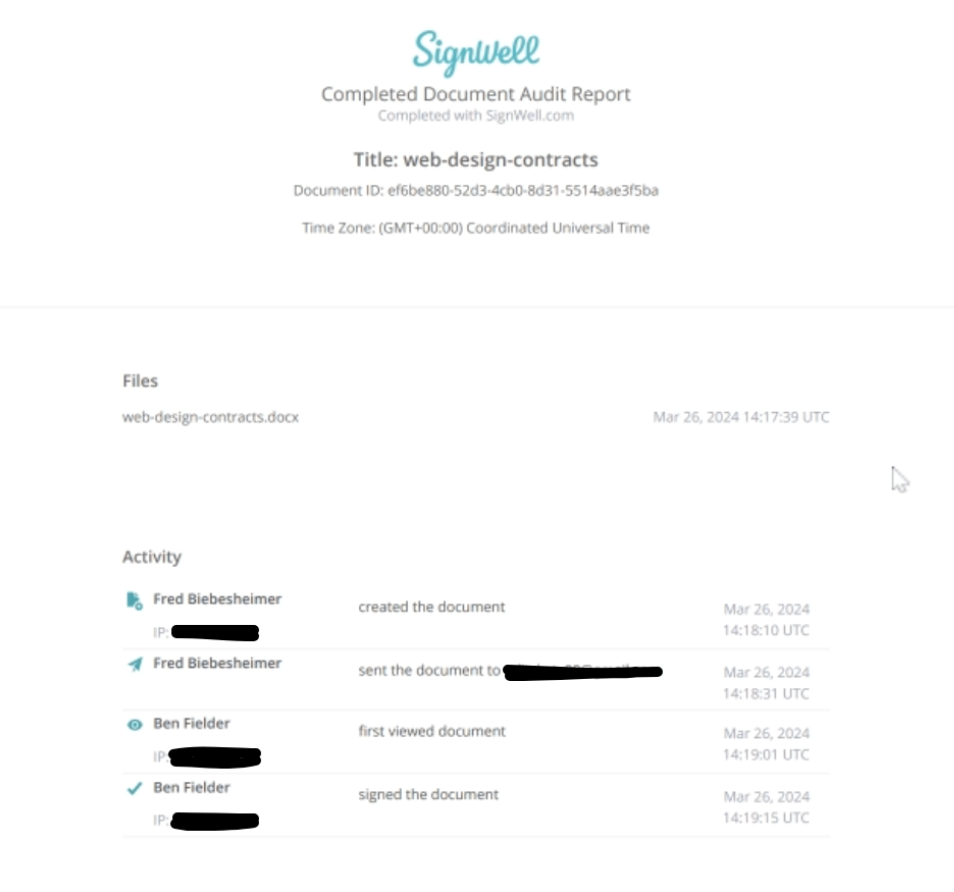

E-signing platforms support compliance and auditability in accountancy by providing detailed audit trails that track every action on a document, such as who accessed, signed, or modified it, along with timestamps and IP addresses.

This ensures transparency and accountability, helping accountants meet legal requirements like ESIGN in the U.S. and eIDAS in the EU.

SignWell enhances compliance and auditability for accountants through several solid features:

- Detailed audit trails: We track all document activities for full traceability and accountability.

- Document version control: Accountants can verify document versions and changes, ensuring that the correct version is signed.

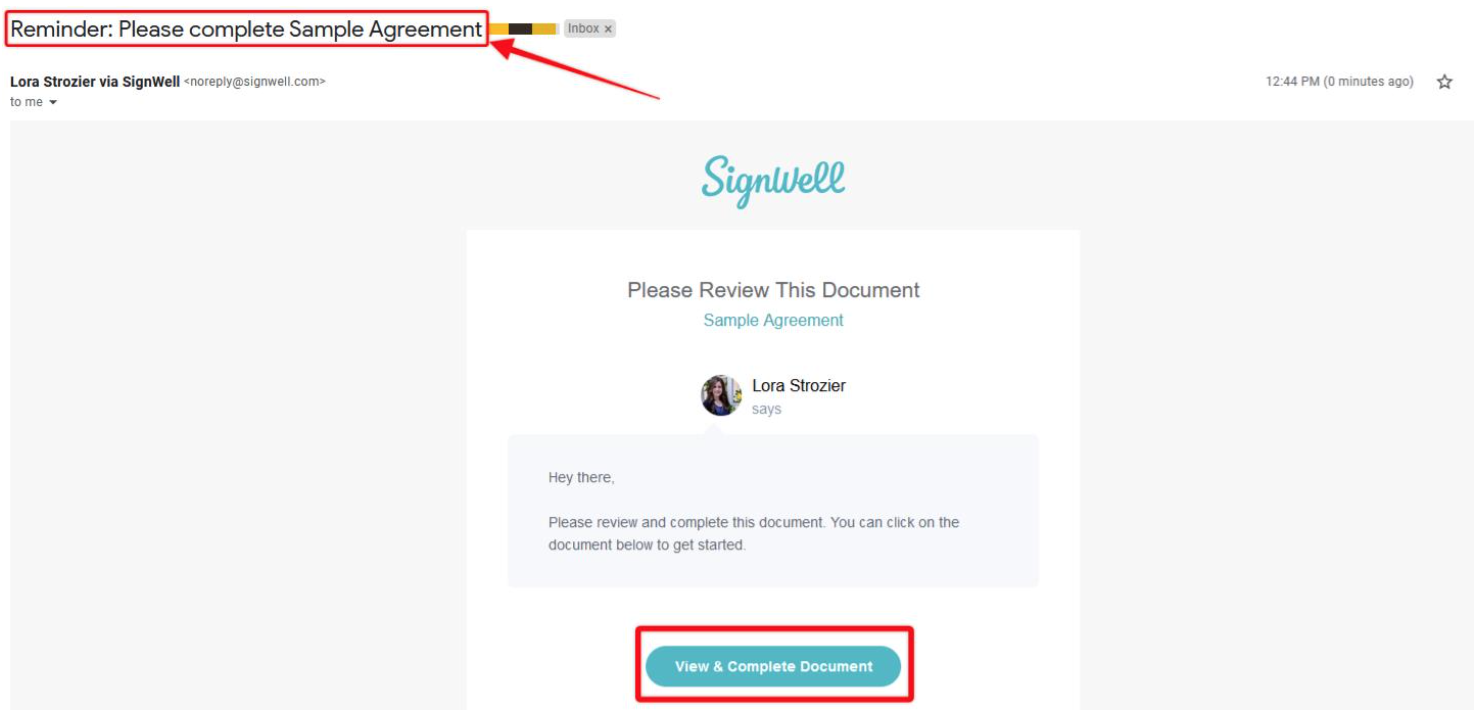

- Automated reminders: Send reminders to ensure timely signatures and compliance with financial reporting deadlines.

- Secure document storage and encryption: Encryption protects sensitive financial data, reducing the risk of unauthorized access.

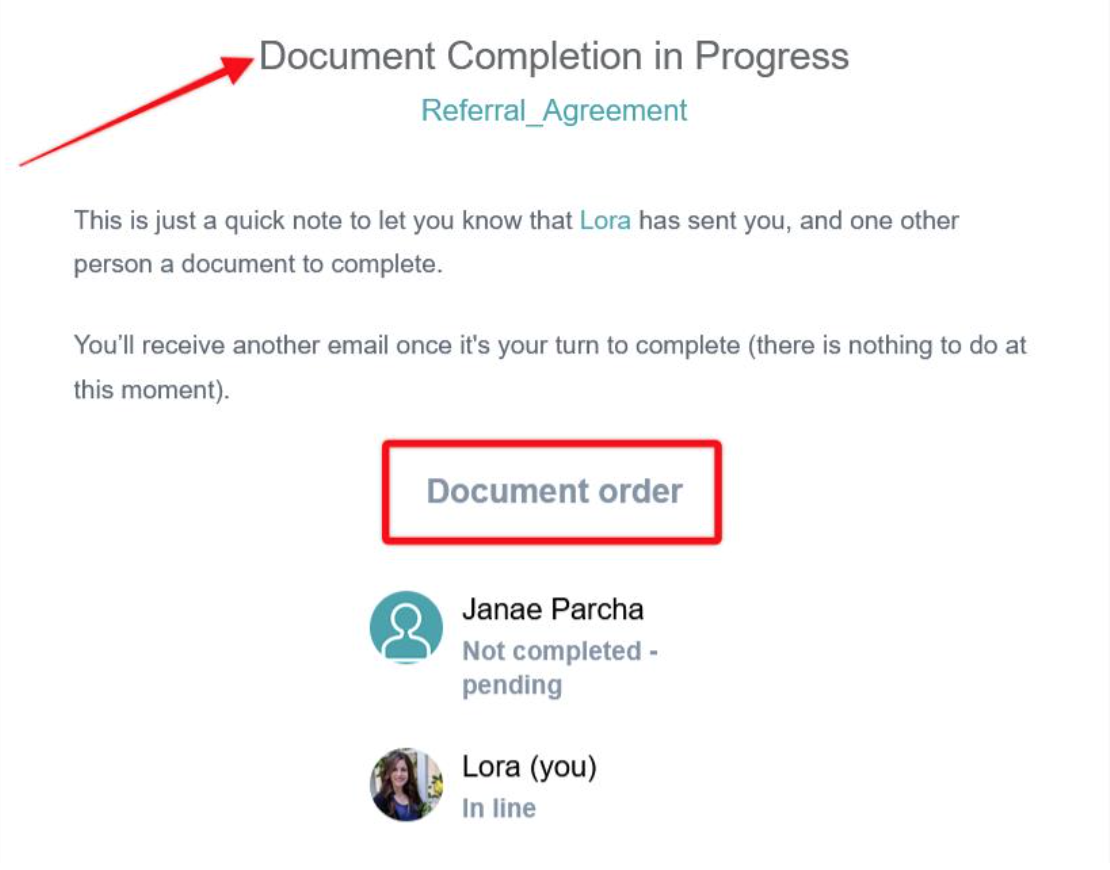

- Document order: Accountants can maintain a structured signing sequence for multi-party financial documents, ensuring authorization and compliance.

By leveraging these features, accountants can create more robust audit trails, better protect sensitive client information, standardize critical processes, and demonstrate regulatory compliance.

5. Enhanced Client Experience

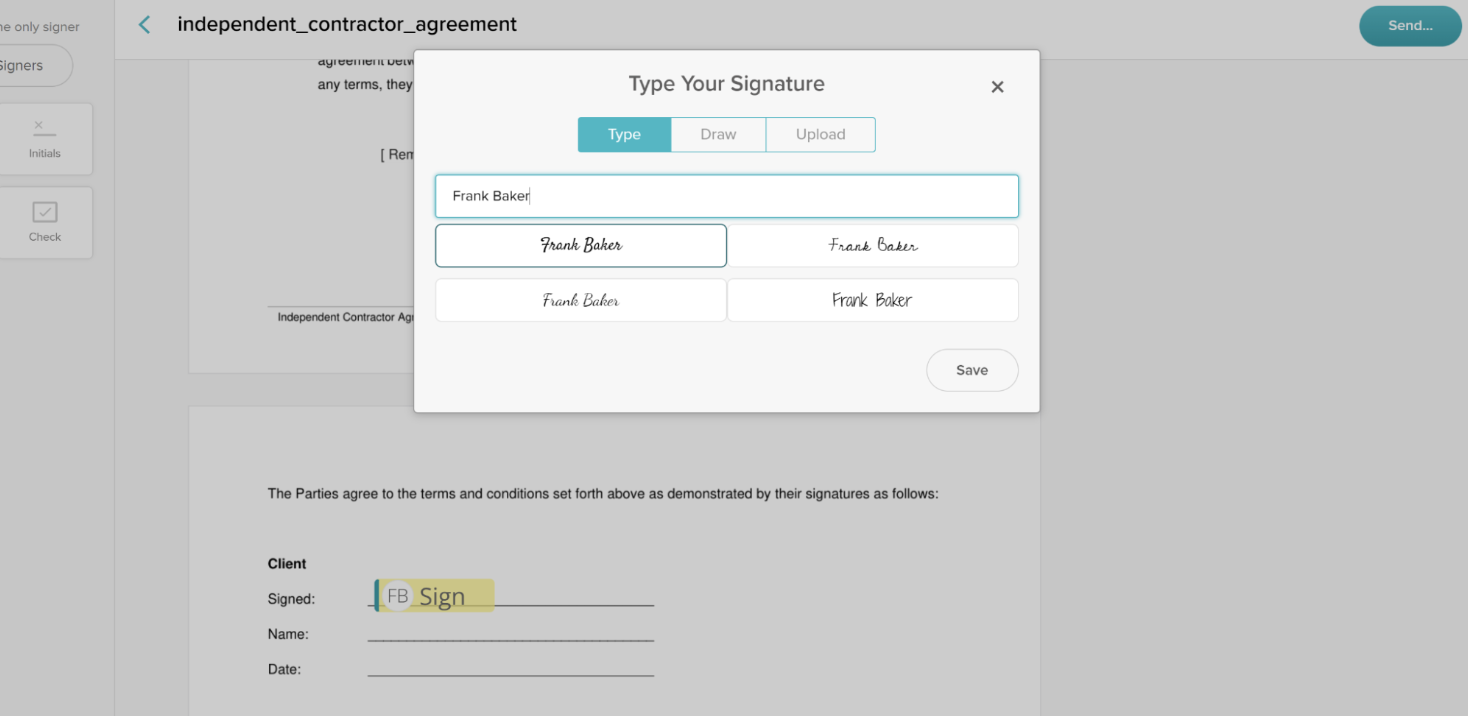

E-signing can improve the client experience by significantly reducing document turnaround times. This convenience allows your clients to sign documents from anywhere, at any time, using any device, streamlining the entire process and eliminating the hassle of printing and mailing.

Our embedded signatures allow users to fill out and sign documents directly on your website or application, eliminating unnecessary steps. This method provides a secure, familiar environment for signers to instill peace of mind regarding the safety and security of their signatures.

It also enhances the user experience by providing a seamless, efficient way to complete transactions without redirecting to external platforms.

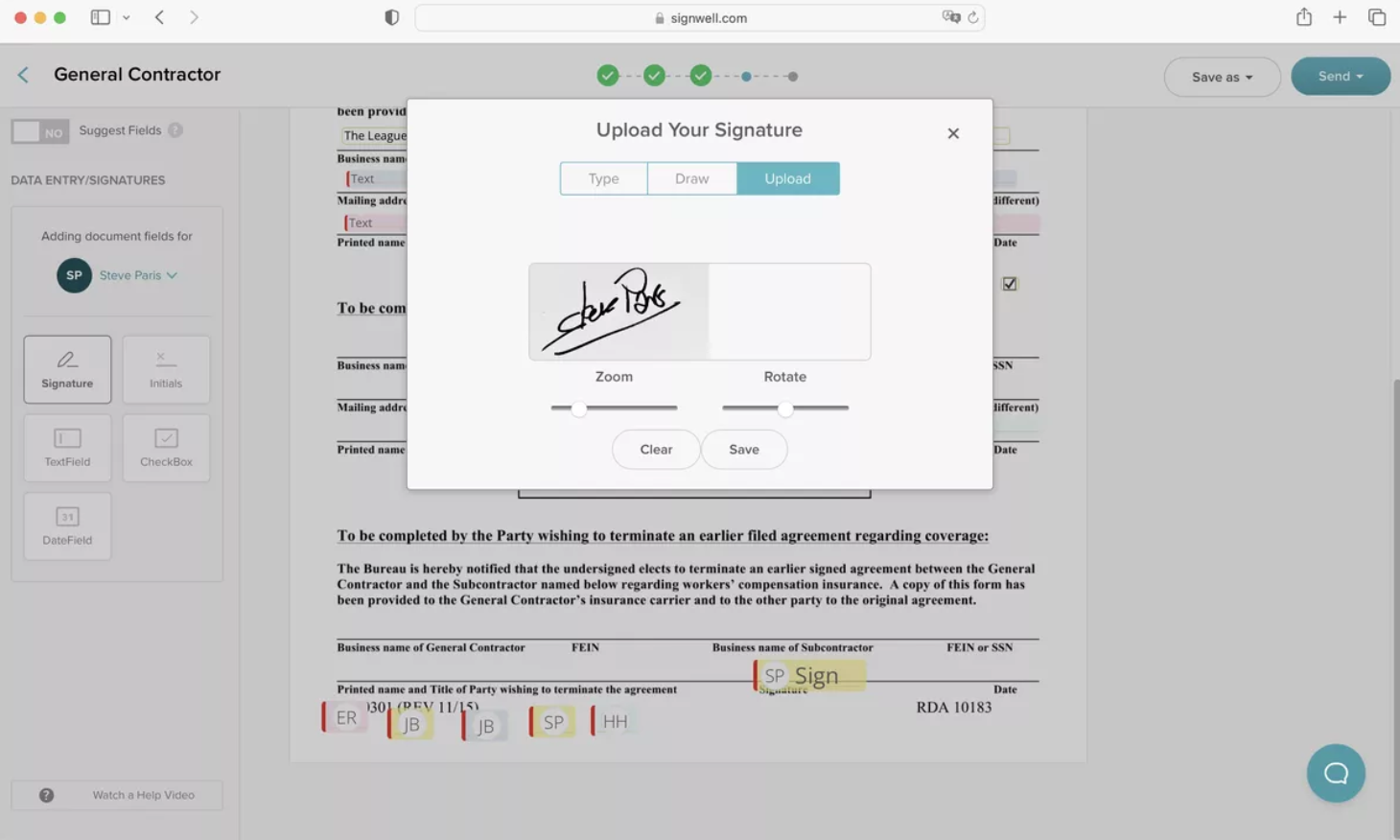

SignWell encourages those reluctant to sign online by making the e-signing process more intuitive. Our user-friendly interface guides signers through each step of document signing.

We deliver a simplified experience with clear instructions and visual cues, allowing people unfamiliar with e-signatures to complete the process quickly.

Our platform design accelerates document preparation, signature placement, and final submission, reducing confusion and improving overall efficiency for you and your signers.

6. Better Collaboration

E-signing enhances collaboration for accountants by enabling seamless document sharing and real-time signing, which reduces delays caused by physical document exchange. With automated workflows and reminders, team members and clients can stay informed about document statuses, ensuring timely approvals and reducing bottlenecks.

We help accountants enhance collaboration in their practice through features like:

- Real-time tracking: Monitor the status of documents in real time to stay updated on the progress of crucial financial paperwork.

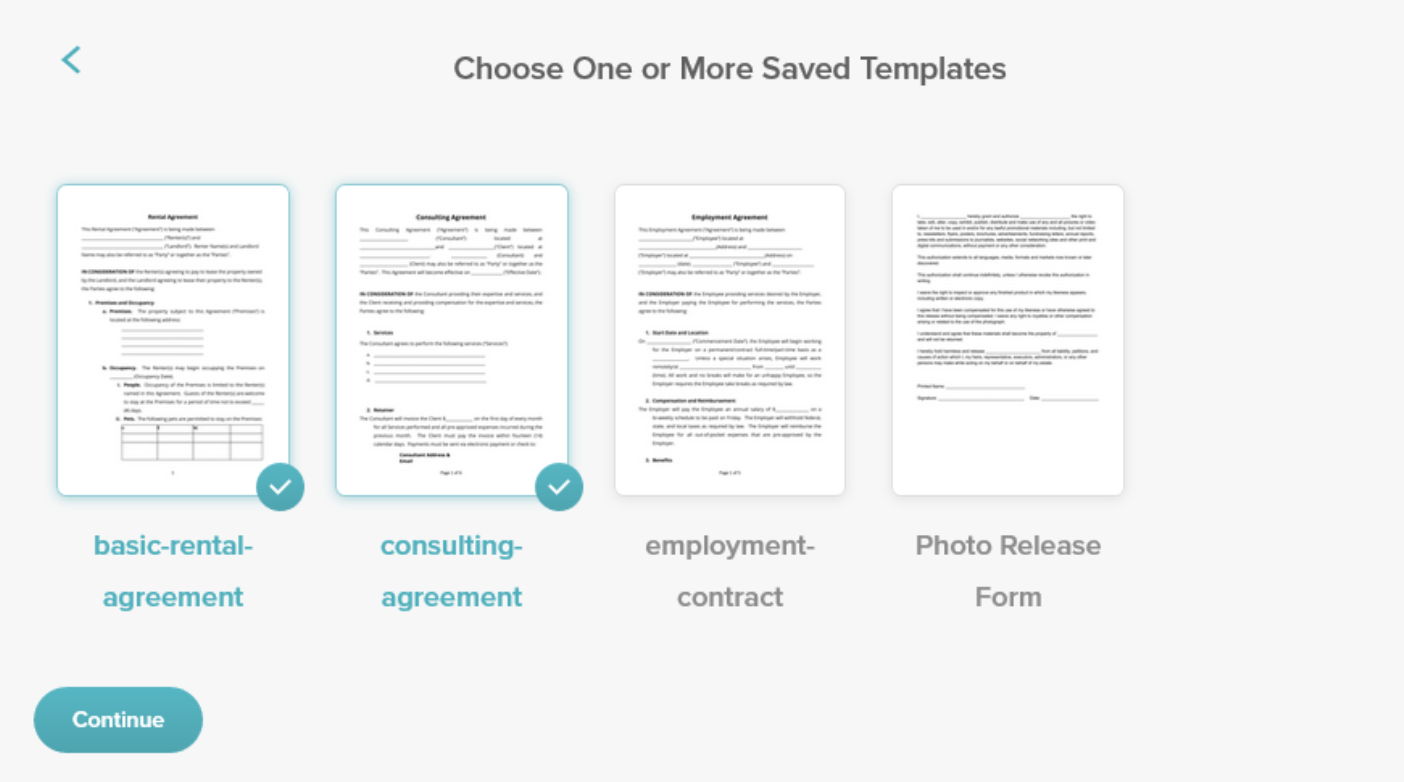

- Document templates: We let you create and save templates for standard accounting documents like estimates, proposals, contracts, and invoices. Save time and ensure consistency across client interactions.

- Document sharing and tracking: Share presentations and other documents online and track whether recipients have viewed them. Very useful for client communications and follow-ups.

Additionally, you can automate workflows and connect e-signing processes with other tools that your business or customers use. We integrate with over 5,000 apps through Zapier, including popular tools like Google Sheets, Slack, and Trello.

7. Competitive Advantage

Accountants using e-signing technology gain a competitive edge by positioning their firms as forward-thinking and technologically savvy. By integrating e-signatures, firms demonstrate a commitment to efficiency, innovation, and client convenience, which appeals to modern, tech-savvy clients looking for seamless digital experiences.

In addition to using an intuitive e-signing solution like SignWell, here are some ways you can promote the use of e-signatures to customers:

- Highlight the use of cutting-edge tech in marketing materials and client communications.

- Emphasize the benefits of e-signing, such as faster turnaround times and improved security.

- Showcase how your firm’s adoption of electronic signatures translates to better service and value for customers.

8. Environmental Benefits

E-signing offers significant environmental benefits for accounting firms by reducing paper consumption and associated waste. Here are some key environmental advantages and interesting stats.

-

Reduced paper consumption

The average office worker in the U.S. uses about 10,000 sheets of paper annually.

By adopting e-signatures, accounting firms can drastically reduce their paper usage. Additionally, businesses save 85% on document handling costs and reduce 80% of their shipping expenses when using e-signatures.

-

Decreased deforestation

The pulp and paper industry plays a major role in global deforestation, contributing between 33% and 40% of all industrial wood traded globally. This equates to roughly 13% to 15% of total wood consumption worldwide, with the paper industry relying heavily on virgin wood to produce products like office paper, tissue, and packaging.

Businesses adopting e-signing tech help conserve forests by replacing paper-based processes. They reduce the demand for pulpwood, preventing further forest degradation.

-

Lower carbon emissions

Paper accounts for 26% of total waste in landfills. By reducing paper usage through electronic signing, accounting firms can help decrease methane emissions from landfills, a potent greenhouse gas.

-

Water conservation

Paper production is water-intensive. A single sheet of A4 paper requires between 2 and 13 liters of water, depending on the manufacturing process and location. E-signing helps conserve water and reduce resource consumption.

SignWell: Transforming Accounting Practices Through E-Signatures

Electronic signatures offer accountants a multitude of benefits, from enhanced efficiency and security to improved client experiences and environmental sustainability. By embracing this technology, accounting firms can optimize operations, reduce costs, and gain a competitive edge in an increasingly digital landscape.

Don’t let your accounting practice fall behind. Start revolutionizing your workflow today by signing up with SignWell for intuitive e-signing. Experience how our platform can transform your document processes and elevate your clients’ experiences.

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction