Quick Summary

This article highlights the benefits of e-signatures in banking, such as time savings, cost reduction, and enhanced customer experience. SignWell’s experience with millions of e-signatures ensures secure and streamlined operations. We recommend adopting SignWell for secure banking e-signatures, and visiting our blog for tips on maximizing e-signatures in various industries.

Want to Take Full Advantage of E-Signature in Banking?

Technology has changed many industries, and banking is no exception. Traditionally, opening accounts or applying for loans required in-person meetings and paper signatures. Now, with electronic signatures (e-signatures), these processes are much more streamlined.

Banks use e-signatures to make their services faster and more convenient. Customers can sign documents online, anytime and anywhere. This comes with several benefits for both banks and their customers.

For example, AMOCO Federal Credit Union, based in Houston, implemented e-signatures to enable members living abroad to open accounts, apply for loans, and complete transactions remotely. This reduced the loan and account origination turnaround by about 20%.

In this SignWell article, we’ll discuss how e-signatures can benefit the banking industry and important considerations to make before using the technology.

Why Listen to Us?

At SignWell, we’re committed to helping businesses and organizations collect legally binding electronic signatures. We’ve processed over 4,000,000 signed documents across different industries and sectors, including banking.

We have a first-hand understanding of the capabilities of e-signature tools and how different industries, including banking, can leverage them to streamline workflows and improve the trust of customers, all while staying legally compliant.

Are E-Signatures Legal in Banking?

Yes, e-signatures are legal in banking. The 1999 Uniform Electronic Transactions Act (UETA) and the 2000 federal E-Sign Act made electronic signatures as valid as handwritten ones across the U.S.

Although New York uses its own Electronic Signatures and Records Act (ESRA), it also recognizes e-signatures as legally binding. This means that e-signatures are accepted in every state, making them a safe and legal option for banking transactions.

6 Ways E-signatures Can Benefit the Banking Industry

1. Enhanced Security and Fraud Prevention

E-signatures offer security measures that paper documents simply can’t provide. Paper documents are prone to loss, theft, or tampering. With e-signatures, banks can stop worrying about the integrity, security, and storage of documents transferred between individuals and systems. It mitigates risks with features like:

- Strong Encryption: E-signatures use strong encryption to protect documents. Once signed, no one can change the document without breaking the signature. This keeps the document safe and tamper-proof.

- Multiple Authentication Steps: E-signatures often require several steps to verify who is signing. This can include passwords, fingerprints, or codes sent to the client’s phone. These steps make it hard for anyone else to forge a signature or access sensitive information.

- Clear Audit Trails: E-signature technology tracks and records every action on a document. For example, our tool, SignWell, records the history of documents with detailed audit reports. These reports include when each document has been opened and signed with time stamps and full visibility into document activity.

This transparency helps track and verify the signing process, making it easier to spot and stop fraud.

2. More Streamlined Processes

Electronic signatures can streamline a lot of important processes in the banking industry, making them faster and more efficient. These include:

- Account Opening: Customers can open accounts entirely online by signing forms digitally. No need to visit branches, and processing times are cut significantly.

- Customer Onboarding: New clients sign all onboarding paperwork electronically, eliminating delays. This accelerates their integration into the bank’s system.

- Loan and Credit Card Applications: Customers apply for loans or credit cards online, and e-signatures allow them to finalize applications instantly. Banks also process approvals faster.

- Processing Mortgages: Homebuyers can sign every mortgage document electronically. This speeds up the traditionally long mortgage process, reducing potential delays.

- Customer Information Updates: Customers update personal details, such as their address or phone number, by signing online forms. Banks instantly reflect these changes, avoiding paperwork and errors.

3. Improved Document Automation and Workflow Management

With e-signatures, banks can eliminate repetitiveness and adopt automation.

For example, automating signature collection and document monitoring can improve workflows and reduce the chances of errors. It also reduces turnaround times and frees staff from tedious tasks, allowing them to focus on higher-value work.

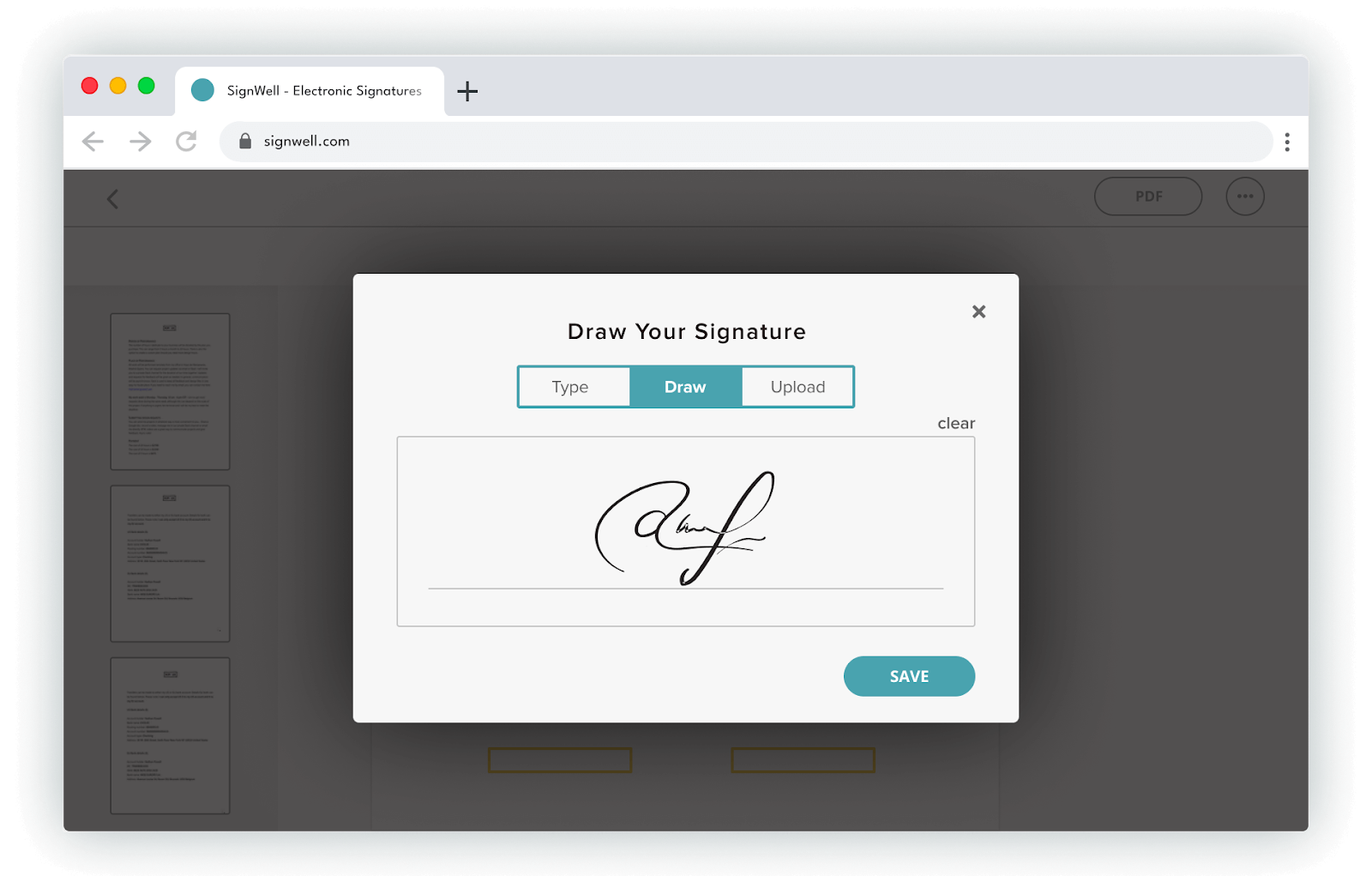

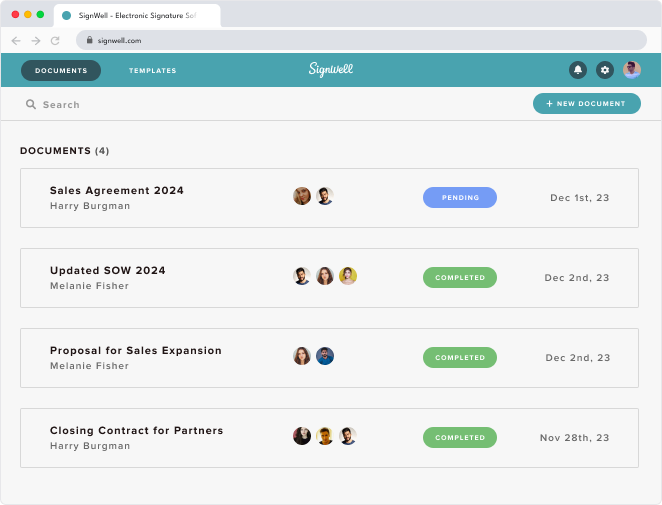

Banks can use SignWell to improve their document workflows. With our tool, you get real-time tracking to see outstanding signatures and completed documents. You can also choose who to sign and in what order, keeping the process moving with automatic notifications.

Each recipient also receives a fully guided experience to show them how to sign documents correctly.

4. Save Resources and Costs

Electronic signatures can save banks money on expensive screening materials and labor-intensive time. According to research, businesses can save $20 per document and reduce turnaround time by 80% with electronic signature software.

Here’s how e-signatures can help banks save resources and costs:

- Reduce Paper and Printing Costs: E-signatures eliminate the need for paper, ink, and printers. This reduces supply expenses and minimizes environmental impact by cutting down on paper waste.

- Lower Mailing Expenses: With e-signatures, you avoid mailing documents altogether. This removes postage costs, shortens delivery times, and speeds up client interactions.

- Decrease Storage Needs: Documents will be stored digitally, reducing physical storage costs. Electronic storage also simplifies access to files and records.

5. Improved Customer Experience and Trust

Today’s customers expect convenience and transparency from their banks, similar to what fintech products offer. eSignatures help banks meet these expectations in several ways:

- Convenience: Customers can sign documents from any location, using any device, at any time. This flexibility eliminates the need for in-person visits, making banking more accessible.

- Transparent Processes: eSignatures come with detailed audit trails that allow banks to update customers in real time about the progress of their requests, improving trust.

- Faster Service: With instant access to signed documents, banks can process requests immediately, reducing delays compared to traditional methods like mailing or faxing.

These features not only enhance convenience but also build stronger trust with customers by offering faster, more reliable service.

6. Effective Regulatory Compliance

Regulatory compliance is crucial in the banking industry. The legal enforceability of e-signatures helps banks meet strict compliance standards. E-signatures offer:

- Non-repudiation: Electronic signatures provide proof of identity and intent because each signer is uniquely linked to their digital approval. This ensures they cannot deny their participation.

- Data Integrity: Documents signed electronically cannot be altered without detection, ensuring the content remains secure and reliable.

- Document Control: You can determine who accesses and signs the documents. You can also restrict what signers can do with the document, such as printing or copying (although this may vary depending on the e-signature software used).

- Data Protection Compliance: Electronic signatures ensure that you comply with data protection regulations like safe storage, deletion, and prevention of unauthorized access to personal data.

Considerations When Using eSignatures in Banking

While e-signatures can benefit banks in different ways, it’s important to implement and use them correctly. Here are a few things to note:

1. Develop a Comprehensive E-Signature Policy

An electronic signature policy ensures the secure, consistent use of e-signatures in a bank. The major components of an e-signature policy are:

- Security Protocols: Protect the safety and accuracy of electronic transactions to keep them secure.

- Privacy Measures: Explain how the bank protects customer information during the e-signature process.

- Legal Compliance: Make sure e-signatures follow laws like the ESIGN Act and UETA.

- Document Management: Set rules for how the bank stores and manages signed documents.

- Customer Consent: Ensure customers know and agree to using e-signatures.

- User Authentication: Confirm users’ identities before they can sign electronically to prevent fraud.

Creating an e-signature policy ensures all stakeholders—employees, clients, and partners—follow best practices and legal requirements, minimizing misuse and enhancing trust in the process.

2. Manage Risk and Regulatory Nuances

Banks need to consider both state and federal laws when using e-signatures, especially if they operate in different states. For example, a loan signed electronically in New Jersey might face issues if sold in New York, which has different rules.

A hybrid approach works well (e.g., using e-signatures for certain transactions and physical signatures for those involving other states or parties).

3. Authentication

Banks should verify the identity of signers to ensure valid e-signatures. A Certificate Authority (CA) can confirm a signer’s identity and provide a digital certificate. Most banks find it easier to use third-party services rather than becoming their own CA.

4. Storage

Storing e-signature documents securely is key. Banks must develop comprehensive plans that outline document storage locations, implement robust security protocols, and establish effective disaster recovery strategies. This may involve technology upgrades, staff training, or hiring experts to manage secure storage.

5. Choose the Right Software

It’s important to choose the right e-signature software to ensure the security, efficiency, and intuitiveness of the entire process.

Here are some key factors to consider when choosing an e-signature solution:

- Integration: The software should integrate easily with the bank’s systems for smooth workflows.

- Security: Ensure strong security features like encryption and multi-factor authentication.

- Intuitiveness: It should be easy for employees and customers to use.

- Customization: The software should allow tailored workflows and templates.

- Compliance: Make sure it follows e-signature laws in the United States and internationally.

Enjoy the Full Benefits of E-Signatures for Banking with SignWell

In the banking industry, your e-signature solution is as good as the software powering it. SignWell is a great e-signature solution for banks, offering a secure, legally binding platform with easy-to-use features like audit trails, signature templates, integrations, and workflow automation.

With our tool, you can confidently collect e-signatures that are secure and compliant with strict U.S. and international e-signature and document handling laws. These include SOC 2 Type 2, eIDAS, ESIGN, GDPR, and HIPAA.

Sign up today for free.

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction