Quick Summary

This article explains the importance of a Qualified Electronic Signature (QES) for high-security documents, covering its features, how to obtain one, and when to use it. It also discusses simpler alternatives like Advanced and Simple Electronic Signatures, with SignWell offering a flexible, secure solution for various business needs.

Want to Sign Documents with Maximum Legal Protection?

When signing important contracts, legal agreements, or financial documents, ensuring maximum security and legal validity is crucial. A Qualified Electronic Signature (QES) offers the highest level of trust, security, and compliance, making it legally equivalent to a handwritten signature in many jurisdictions.

In this SignWell article, we’re going to explain what a Qualified Electronic Signature is, how it works, and why it provides the strongest legal protection for your digital documents.

But first…

Why Trust Us?

At SignWell, we specialize in secure, legally binding electronic signatures that simplify and streamline the document signing process. With our expertise in digital authentication and compliance, we understand what sets a Qualified Electronic Signature (QES) apart as the highest standard of security and legal validity.

Whether you’re looking to implement a QES for regulatory compliance or simply want to understand its benefits, you can trust us to provide clear, reliable insights backed by industry best practices.

What Is a Qualified Electronic Signature?

A Qualified Electronic Signature (QES) is the highest and most secure level of electronic signature, meeting strict legal and security requirements. It is designed to ensure the authenticity, integrity, and legal validity of digital transactions.

A QES is legally equivalent to a handwritten signature in many jurisdictions, including the European Union under the eIDAS Regulation (EU No. 910/2014). This means that a document signed with a QES holds the same legal weight as a traditional paper-based signature, making it the most reliable choice for high-value contracts and regulated industries.

Key Features of a Qualified Electronic Signature (QES)

- Identity Verification: Requires face-to-face or remote identity verification to ensure the signer’s authenticity.

- Certified by a QTSP: Issued by a government-approved Qualified Trust Service Provider (QTSP) for added trust.

- Tamper-Proof Security: Cryptographic protection prevents alterations, ensuring document integrity.

- Legal Recognition: Recognized as legally equivalent to a handwritten signature under eIDAS and other global regulations.

Other Types of Electronic Signatures

While a Qualified Electronic Signature (QES) offers the highest level of legal protection, there are two other types of electronic signatures:

1. Simple Electronic Signature (SES)

A Simple Electronic Signature (SES) is the most basic form of e-signature. It can be as simple as typing a name, checking a box, or inserting an image of a handwritten signature into a document. While SES is convenient and easy to use, it lacks identity verification and strong legal standing, making it suitable only for low-risk agreements like internal approvals or informal agreements.

Wondering if your signature can be anything? We’ve answered that in this article.

2. Advanced Electronic Signature (AES)

An Advanced Electronic Signature (AES) steps things up a notch. It’s uniquely linked to the signer, making it much harder to forge. Plus, it can detect if the document has been tampered with after signing. This means AES is great for situations where you need stronger security and legal standing but don’t necessarily require the full weight of a QES.

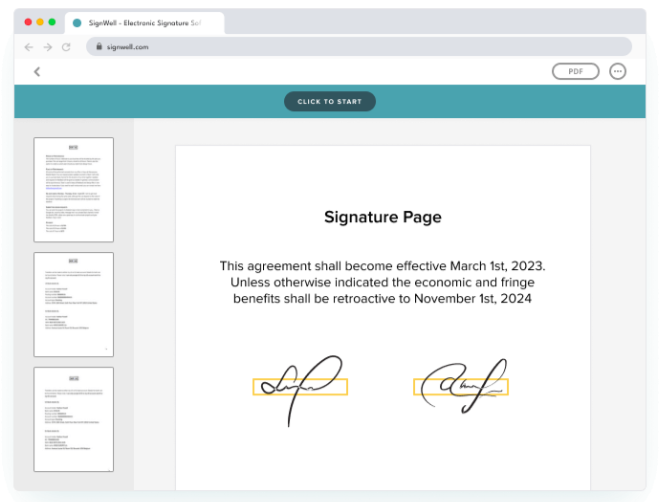

This is exactly where SignWell comes in. We offer a secure and legally binding electronic signature platform that aligns with advanced e-signature standards. Our platform makes it easy for businesses to collect signatures while ensuring compliance with U.S. and international e-signature laws. Whether you need to sign a simple agreement or something more legally robust, we’ve got you covered.

How to Get a Qualified Electronic Signature

Getting a Qualified Electronic Signature (QES) requires a few extra steps compared to a standard e-signature, but that’s what makes it so secure and legally robust. Here’s how you can obtain one:

1. Choose a Qualified Trust Service Provider (QTSP)

Not all digital signature providers can issue a QES, you’ll need to go through a government-approved Qualified Trust Service Provider (QTSP). Some well-known QTSPs include DigiCert, GlobalSign, and DocuSign. These providers are certified to issue qualified digital certificates that meet strict security and legal standards.

2. Complete the Identity Verification Process

Before you receive your qualified certificate, you’ll need to verify your identity. This can be done remotely via video identification or in-person at an authorized location. The QTSP will confirm your identity using official documents like a passport or national ID card.

3. Obtain a Qualified Digital Certificate

Once your identity is verified, the QTSP will issue your qualified digital certificate. This unique certificate is securely stored on a cryptographic device, such as a smart card, USB token, or cloud-based HSM (Hardware Security Module).

4. Use a Compatible E-Signature Platform

To sign documents with a Qualified Electronic Signature (QES), you need software that supports it. Unfortunately, SignWell doesn’t support QES yet, but DocuSign does. They offer QES-compliant signing through their Standards-Based Signatures, which integrate with global Trust Service Providers (TSPs) for EU eIDAS compliance.

When Should You Use a Qualified Electronic Signature?

High-Value Contracts

For significant transactions, like real estate deals or mergers & acquisitions, a QES ensures both parties’ identities are verified, and the agreement is tamper-proof. These documents often involve large sums of money, so it’s important that both sides have the peace of mind that the deal is legally binding and secure.

Government Filings

When you’re submitting official documents to government bodies; whether it’s tax forms, official records, or compliance documents, having a QES adds an extra layer of trust and ensures that your submission meets all legal requirements under regulations like eIDAS.

Financial Transactions

Loan agreements, banking authorizations, and other financial transactions often require a QES to meet regulatory requirements. These documents can involve large financial commitments, so using a QES guarantees that the signatory’s identity is verified and protected against fraud.

Healthcare Documents

In the healthcare sector, especially in HIPAA-compliant environments, patient consent forms and other medical documents must be signed with a QES to ensure both security and legal compliance. It’s crucial for protecting sensitive patient information and adhering to industry regulations.

Get the Right Signature for Your Business with SignWell

A Qualified Electronic Signature (QES) offers the highest level of security and legal recognition, making it essential for high-value transactions, government filings, and financial agreements. But, if you need a simpler, more flexible solution without the complex setup, there are other great options available.

SignWell provides easy-to-use, legally-binding electronic signatures that work for a wide range of needs, from basic signatures to more advanced features. Whether you’re closing deals, securing approvals, or streamlining workflows, SignWell makes document signing simple and secure, no need for a QES when you have the flexibility to scale with your needs.

Ready to simplify your signing process? Sign up with SignWell today.

Sign with a team that knows what you need.

Putting a signature on a document shouldn’t be hard. The SignWell mission? Simplify how documents get signed for millions of people and businesses.

Get Started Todaybusinesses served, so far...

total documents signed

customer support satisfaction